The Eagle Has Landed

Bob Hughes

Economist at DesignIntelligence

April 24, 2024

DI economist Bob Hughes offers a mid-year update.

In March 2022, the Federal Reserve began raising the target for the Federal Funds rate, the interest rate that banks charge each other for overnight loans, with the goal of bringing down surging inflation (the rate of increase in prices). The ideal result would be a deceleration of inflation from over 8% annually on the total Consumer Price Index (over 6% annually on the core Consumer Price Index) to the Fed’s goal of 2% without causing a recession, a so-called soft landing. As with most economic trends, the process took some time, but with 2023 complete and the first quarter of 2024 well along, key measures of economic growth, inflation, and unemployment suggest that goal has been achieved. Indeed, as Neil Armstrong said after guiding the Apollo 11 lunar craft to a landing on the Moon on July 20, 1969, “…the eagle has landed.”

Growth

Real Gross Domestic Product (GDP) rose at a 3.2% annualized rate in the fourth quarter of 2023 versus the third quarter and 3.1% from the fourth quarter of 2022. Our preferred measure of domestic demand, real final sales to private domestic purchasers excluding owners rent (aka real core GDP), rose 3.0% at an annual rate in the final quarter of 2023 and is up 2.9% since the fourth quarter of 2022. In fact, our preferred measure has shown growth in 13 of the last 14 quarters with the one negative quarter (Q4 2022) coming in at a barely negative -0.3%. Those results suggest a resilient economy with solid growth.

Inflation

On the inflation front, the total Consumer Price Index (CPI) is up 3.2% for the 12 months ended February 2024, well below the peak near 9% but still above the Fed’s goal of 2%. The Core CPI, which excludes food and energy prices because of their volatility, is up 3.8% over the same period. However, our preferred measure, the CPI excluding energy and owners’ equivalent rent (OER) is up 1.7% through February, the fifth consecutive month below the Fed’s 2% target.

OER is a hypothetical number that attempts to estimate what homeowners would pay themselves to live in the house they own. However, nobody actually pays OER; there is no transaction. Yet, this hypothetical measure with no real transaction associated with it has a very large weight in the CPI index, nearly 27%, and is up a whopping 6.0% over the latest 12 months, triple the Fed’s 2% goal. The large weight and high rate of increase is pushing up the total and core CPI results.

click to see Inflation: A Deeper Look

Labor

With continued growth in real GDP and real core GDP, and despite 11 interest rate increases by the Federal Reserve, the labor market in the U.S. remains tight. The unemployment rate came in at 3.9% in February 2024, up slightly from 3.4% in early 2023. The 3.4% rate was the lowest since May 1969. Furthermore, as of the end of January 2024, there were about 8 million open jobs in the private sector while February data showed the number of unemployed was about 6.5 million. Though there has been a rise in layoff announcements recently, the level is still low. Furthermore, initial claims for unemployment insurance remain at levels consistent with a tight labor market and solid economic growth.

The Fed

The last of the Fed’s 11 rate increases occurred in July 2023 with the target rate set at 5-1/4 to 5-1/2 percent. With the on-going deceleration in inflation (called disinflation as compared to deflation or falling prices) speculation has been squarely focused on Fed Funds rate cuts. Numerous Fed governors as well as regional Federal Reserve Bank presidents have been strongly discouraging such speculation and reaffirming their commitment to reducing inflation back to their 2% target.

Continued progress towards the Fed’s 2% objective is highly likely given that our preferred measure of CPI excluding energy and OER accounts for about 2/3 of the total CPI and is already under 2% while the OER (27% of the CPI) continues to slowly decelerate. The key question is timing. The OER price index tends to move very slowly and given the relative weights of OER and our preferred measure, if the Fed were to wait until the CPI or core CPI is actually back to 2%, then the Fed Funds rate may remain at current levels for an extended period. If the Fed were to be satisfied with a disinflationary trend, then rate cuts could come before inflation measures reach the Fed’s target. A third possibility is the Fed decides to begin rate cuts before inflation reaches the 2% target but spreads them out over an unusually long period of time. The December Fed projections imply three ¼-point cuts in 2024 leaving the Fed Funds target at 4-1/2 to 4-3/4 percent at the end of 2024.

Another possible scenario is some other developments force earlier and/or more rapid rate cuts. While trends in activity, inflation, and labor are favorable, a shock to the economy could threaten those trends and the outlook. Shocks are, by definition, unpredictable. The good news is that with the Fed Funds rate at 5-1/4 to 5-1/2 percent, there is plenty of room to make aggressive, substantial cuts to respond to any negative shock.

Markets often “climb a wall of worry.”

Outlook

An old saying among stock market veterans is markets often “climb a wall of worry.” There’s always something to worry investors. Today is no different. Two of the biggest sources of worry are global events and Washington dysfunction, especially in a Presidential election year.

War in Israel and war in Ukraine are major concerns. Most horrifying are the humanitarian disasters in both places. Beyond that, the Israel/Gaza conflict is already impacting global trade in critical shipping lanes, threatening supply chains and commerce. Defending the cargo ships passing through the region has drawn the U.S. and allies into limited military engagement. Deeper involvement is a possibility, but the probability seems low.

The unjustified invasion of Ukraine by Russia is significantly increasing the risks of wider regional war between a belligerent Russia and the NATO alliance. More than a few analysts have drawn the comparison between Russia’s aggression and Nazi Germany as fears of World War III seem to be becoming less remote.

International relations, growing fiscal imbalances, government shutdowns, debt defaults, immigration and border policy, industrial policy, even basic U.S. human rights and freedoms are areas in need of policy attention. National security, both traditional forms of warfare and cyber warfare, is under a growing threat. The latter is particularly concerning in an election year with heightened concern over election security and the potential for misinformation campaigns, from domestic and foreign sources, to cause chaos.

These threats are growing at a time of extraordinary, nearly complete dysfunction in the U.S. Congress. The intense partisanship, lack of honesty and integrity, and extreme hostility by so many elected officials as well as political party leadership, state officials, and even the general public have paralyzed policymaking.

Despite these issues, the outlook for the overall macroeconomy is generally positive with favorable trends in growth and inflation, a strong labor market, and eventual Fed rate cuts likely. However, there are areas of concern. Commercial real estate – primarily office space and retail – remains in crisis, still suffering from the fallout of the pandemic and surge in remote work. The tug-of-war to get workers to return continues with no clear victor on the horizon. The disruption to CRE is impacting the banking system. With a substantial amount of property loans coming due and property values depressed, the crisis in CRE and the banking system is still unfolding. While the crisis is a significant problem for the players involved, from a broader macroeconomy perspective, the crisis likely isn’t a major threat. The banking system overall is generally sound, so any individual bank problems are likely to be contained.

Final Points: Resilience & Adaptability

Threats from geopolitical events and a horribly dysfunctional and bitterly partisan Congress notwithstanding, the economic outlook is reasonably upbeat. Economic growth is likely to continue, inflation should decelerate further, and a solid labor market will continue to support consumer spending which will in turn support future growth and investment.

Along with continued economic growth will be continued restructuring of the economy. Work from home remains an unsettled issue, new technologies will transform business processes, reconfiguring global supply chains will impact investment decisions, demographic trends will drive interstate migration, and immigration will help drive population growth. Furthermore, environmental challenges are mounting as climate change distorts weather patterns, biodiversity dwindles, pollution spreads, landfills expand, and toxic chemicals and materials threaten human health.

At the micro level, all businesses need to be adaptable to respond to the constant change in the U.S. and global economies. Staying abreast of the ongoing changes and responding to both threats and opportunities must be standard operating procedure.

The built environment industry is in a unique position to positively impact the both the environment through development of a circular materials economy, adaptive reuse practices, and regenerative building design, and human health and wellbeing through healthier material selections, more thoughtful human-centered design, and nature-based solutions including biophilic design. Importantly, this can all be accomplished while growing a thriving and profitable business.

Inflation: A Deeper Look

Inflation in Brief

Inflation has been one of the biggest topics since the end of the pandemic. However, before the pandemic, inflation had been a non-topic for

so long that many people had little experience with the nuances of prices and inflation. To help improve understanding of the topic, a few

clarifications may be helpful.

First, the difference between price level and price change. Price level is the current price of goods and services. The Consumer price Index is a proxy for the general price level. It is a composite measure of the price of a basket of final consumer goods and services in the economy. The weights of the items in that basket are based on surveys of consumer spending and approximate the relative importance (weights) of all the final consumer goods and services purchased in the U.S. economy.

Inflation typically refers to the rate of change in the general price level. A steady rate of inflation such as the 2% target used by the Federal Reserve indicates steady 2% annual increases in the general price level; prices keep going up but at a slow, consistent pace. Accelerating inflation means prices rise at an increasing pace; inflation goes to 4% per year from 2% per year. If inflation slows but remains positive, it is known as disinflation. The rate of increase decelerates from 4% per year to 2% per year, so prices are still rising but at a slower pace. If the price level was to remain steady, then inflation would be 0%, sometimes called price stability. If prices or the general price level were to decline, then the inflation rate would be negative, also known as deflation. Deflation or falling prices for the general price level in the economy is generally associated severe recessions and economic depression and is considered by most rational economists to be undesirable.

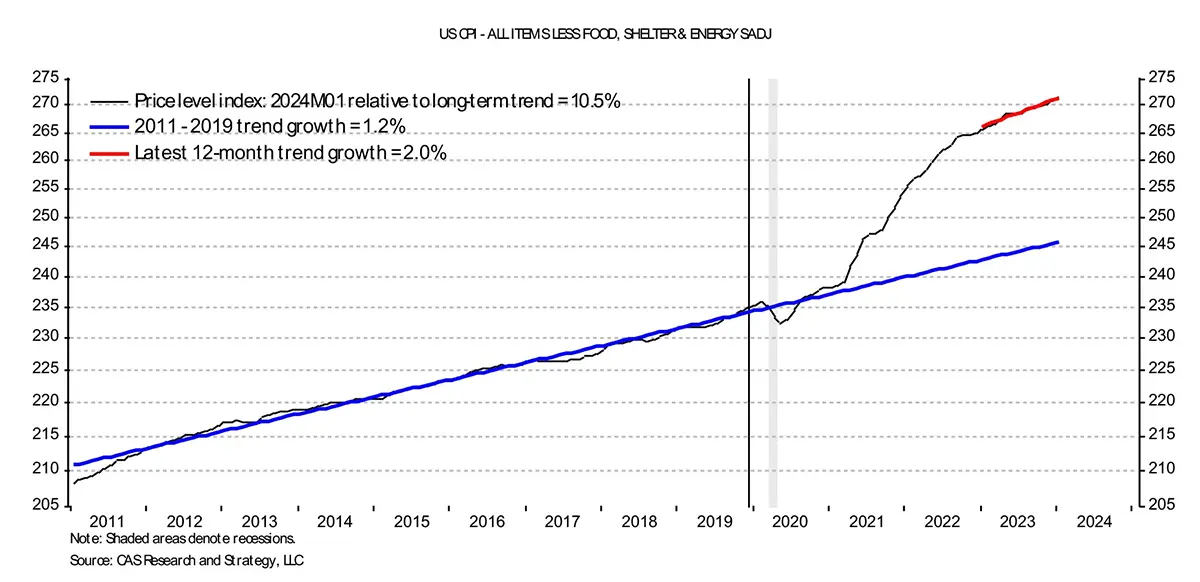

Visualizing the Recent Price Surge

In the chart below, the black line is the CPI excluding food, energy, and shelter. The blue line is the trend growth for the period 2011

through 2019, before the pandemic. The trend growth rate was just 1.2% meaning inflation for that basket of goods and services, consumer

goods and services excluding food and energy because of their volatility and excluding shelter because it is mostly the hypothetical owners’

equivalent rent estimate, was well under the Fed’s 2% target.

Following the pandemic, price increases accelerated, pushing the price level well above the pre-pandemic trend. As of January 2024, the price level was 10.5% above where the price level would have been had the pre-pandemic trend inflation rate of 1.2% persisted.

The red line is the trend growth rate over the latest 12 months through January 2024. The recent trend growth, the current inflation rate, is 2.0%, above the pre-pandemic 1.2% pace but in-line with the Fed’s target for overall inflation.

These numbers help explain why consumers may not feel the benefit of decelerating inflation or disinflation. While the rate of increase in prices has slowed, the price level is high, much higher than just a few years ago. The Fed may have successfully engineered a soft landing, bringing inflation down, but consumers feel the pinch of higher prices (price levels) on family budgets.

Chart 1, author provided

Chart 1, author provided

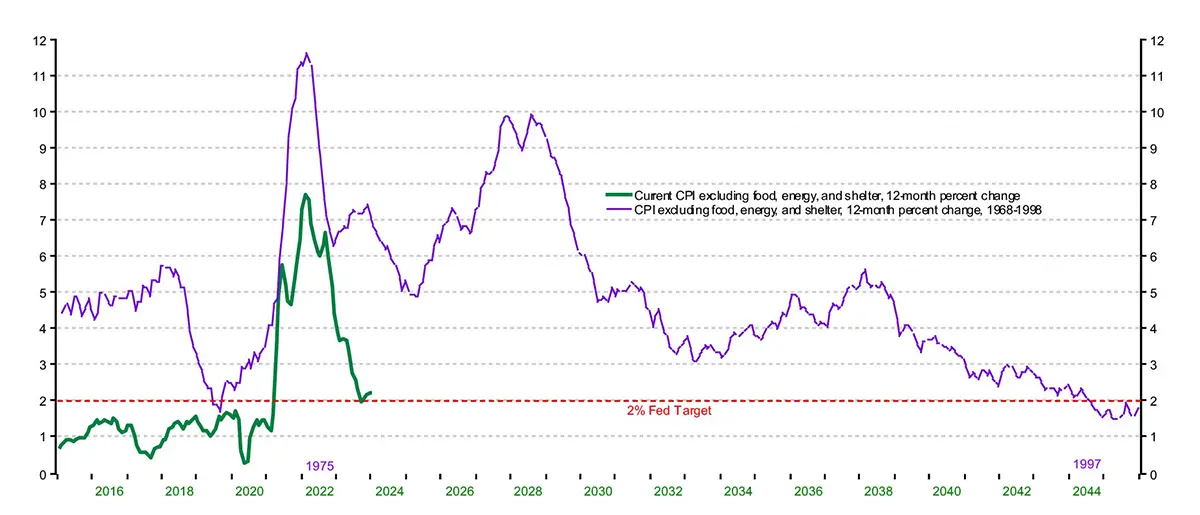

Transitory Inflation

A second important point is that the recent price jump, or surge in inflation, is far less persistent than the one that occurred in the

1970s. Fed Chairman Powell and the other Fed members expected the inflation surge to be “transitory,” meaning high rates of inflation were

unlikely to be sustained for a long period. The term “transitory” has no specific time period associated with it. When inflation

failed to return to pre-pandemic levels within a short time, 6 or 12 or even 18 months, many pundits took the opportunity to slam the

Chairman for his “transitory” statements.

However, a simple comparison to the 1970s shows that the Chairman was right.

Chart

2, author provided

Chart

2, author provided

In the chart above, the green line is the 12-month percent change in the current CPI excluding food, energy, and shelter. The purple line is the same index from the period 1968 through 1998 overlaid on the 2015 through 2045 period. The peak inflation rates were aligned with 1975 matching up with 2022.

From the peak in 1975, it took 22 years, until 1997, for this measure to hit the 2% target. From the February 2022 peak, it took less than 2 years, until September 2023, to return to the 2% threshold.

While Chairman Powell and the Fed will get the criticism – or credit depending on your perspective – it’s really the resilience and flexibility of the economy that was largely responsible for the deceleration in inflation. Monetary policy certainly influences levels of activity and prices, but businesses adapting to new operating conditions and changes in consumer demand allowed supply to increase and significantly contributed to the reduction in upward price pressures.

Bob Hughes is an economist at DesignIntelligence and is a frequent contributor to DI Quarterly.